Like I said back in December, 2026 was going to be a year of expecting the unexpected—and January didn’t waste any time proving that point. The year opened with a flurry of housing headlines: executive orders, Wall Street investors, and mortgage rates finally moving lower. While there have been meaningful developments, the reality is more layered than the headlines suggest.

Here’s what has actually changed in the housing market—and what it means moving forward.

Interest Rates Are Lower, but Not “Low”

One clear and measurable shift in early 2026 is mortgage rates. Rates have eased closer to 6%, marking the first time in several years they’ve consistently hovered at or below that level. Compared to the 7%+ environment of 2024 and parts of 2025, this has helped restore buyer confidence and bring more activity back into the market.

That said, these rates are still a far cry from the historic lows of the COVID era. While lower rates have made monthly payments more manageable for some buyers, they haven’t suddenly unlocked affordability across the board. Buyers are back—but they’re moving carefully.

The Executive Order: What the Headlines Miss

In January, President Trump signed an executive order titled “Stopping Wall Street from Competing with Main Street Homebuyers.” Early coverage made it sound as though large investors were being pushed out of the housing market altogether. That’s not quite accurate.

The executive order:

- Does not ban institutional investors from buying single-family homes

- Does not immediately change who can purchase homes on the open market

- Does not lower home prices overnight

What it does do is direct federal agencies to review how government programs interact with investor purchases. The emphasis is on limiting federal support—such as federally backed loans or guarantees—when large institutional investors are purchasing homes that could reasonably be bought by individual, owner-occupant buyers.

Specifically, the order calls for:

- Limiting government programs from facilitating single-family home purchases by large institutional investors

- “First-look” policies that give individual buyers priority on certain homes, particularly foreclosures

- Reviews by the Treasury Department, HUD, DOJ, and FTC to identify potential anti-competitive practices

- Legislative recommendations to Congress to potentially make these policies permanent

In short, the order establishes a direction and framework, not an immediate market overhaul.

Will This Actually Change the Market?

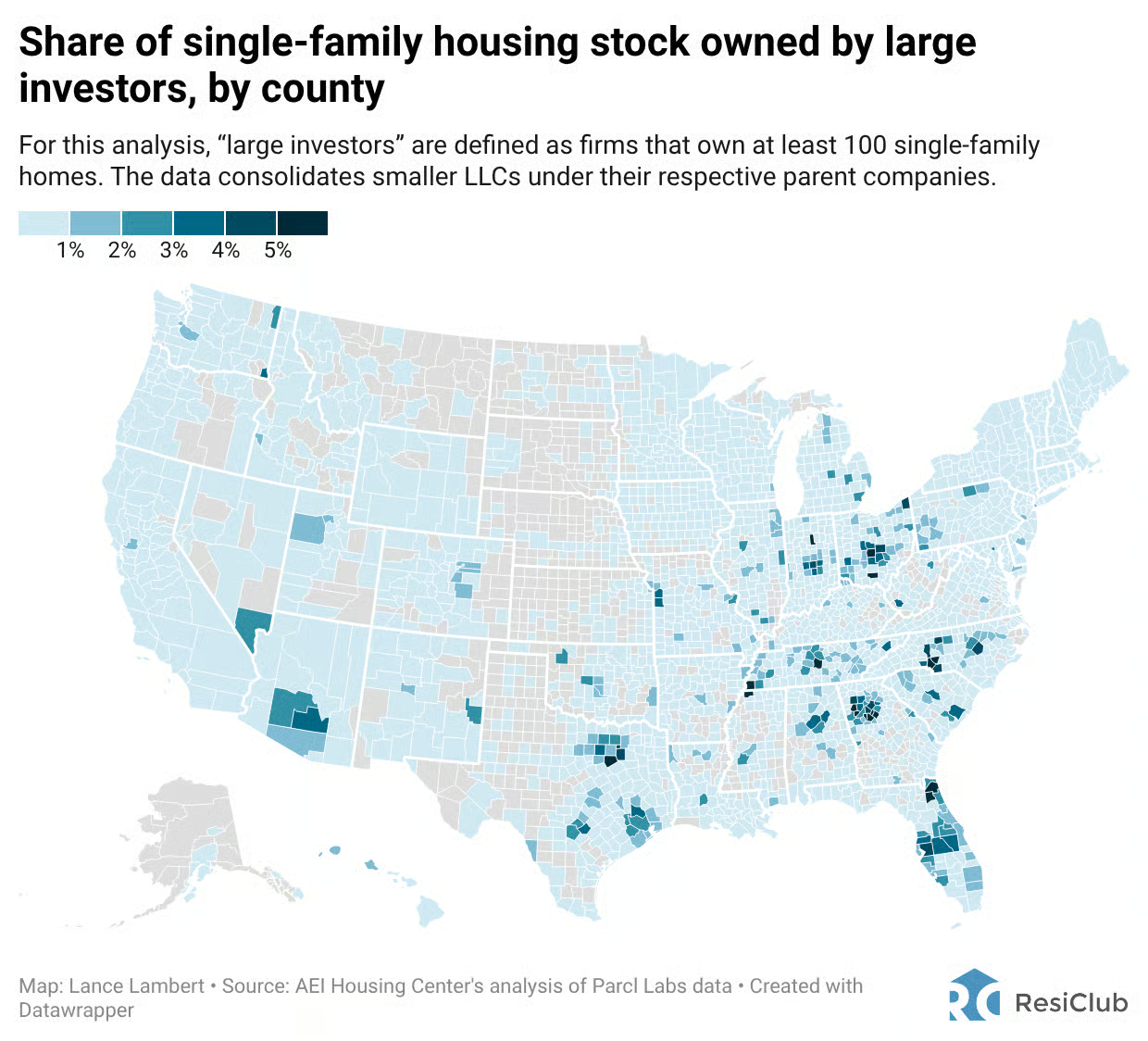

Institutional investors account for a relatively small share of single-family home purchases nationwide—large institutional buyers make up roughly 2% of the market, even though investors overall represent closer to 30–34% of purchases, much of which comes from small, local buyers. Because of that, most analysts agree this executive order alone is unlikely to dramatically shift home prices or inventory levels.

Where it could have an impact is at the margins—especially for entry-level homes in certain markets—by slightly reducing competition for individual buyers over time. But lasting affordability improvements will still depend on something much bigger.

What This Means for Buyers and Sellers

- Buyers may see slightly improved conditions thanks to lower rates and renewed policy focus, but competition hasn’t disappeared.

- Sellers continue to benefit from limited inventory, though pricing accurately matters more now than it did during peak years.

- First-time buyers could see incremental improvements over time—particularly if agency guidance turns into actionable programs.

The Bottom Line

Early 2026 isn’t a reset—it’s a recalibration. Interest rates have softened, policy direction has shifted, and buyer confidence is improving. But the housing market is still grounded in the same fundamentals it’s faced for years.

The headlines make it feel dramatic.

The truth is steadier, slower, and far more realistic—and that’s exactly how meaningful change in housing tends to happen.

Check out the headlines and sources for yourself:

- Fact Sheet: President Donald J. Trump Stops Wall Street from Competing with Main Street Homebuyers

- STOPPING WALL STREET FROM COMPETING WITH MAIN STREET HOMEBUYERS

- Trump Is Moving to Bar Wall Street Firms From Buying Single-Family Homes. Here’s What That Would Mean for Affordability

- NAR Pushes for Action on Housing Affordability

- Real estate investors account for 34% of home sales in Q3 2025

0 Comments Leave a comment